Australian Foreign Direct Investment

Download our full guide today

Recent changes to Australian’s foreign investment regime, designed to improve housing affordability and supply, have now taken effect. These changes primarily involve an increase in fees for the acquisition of residential land by foreign persons and will be of significant interest to foreign developers and foreign investors that intend to acquire an interest or invest in projects involving residential Australian land.

Australia’s foreign investment law generally requires a foreign person intending to purchase Australian real estate to obtain the approval of the Foreign Investment Review Board (FIRB), on either a transaction-specific basis or under a multi-transaction exemption certificate, and to pay the relevant application fee. Our Foreign Direct Investment Guide discusses the scope of Australia’s foreign investment regime in more detail, including who is captured under the regime and the types of transactions that require approval.

Subject to FIRB approval, foreign persons are generally permitted to acquire ‘new dwellings’. However, to protect Australia’s existing housing stock, foreign persons are prohibited from acquiring residential land containing an ‘established dwelling’ (subject to a limited number of exceptions1 and further changes announced on 1 May regarding established ‘build to rent’ properties taking effect).

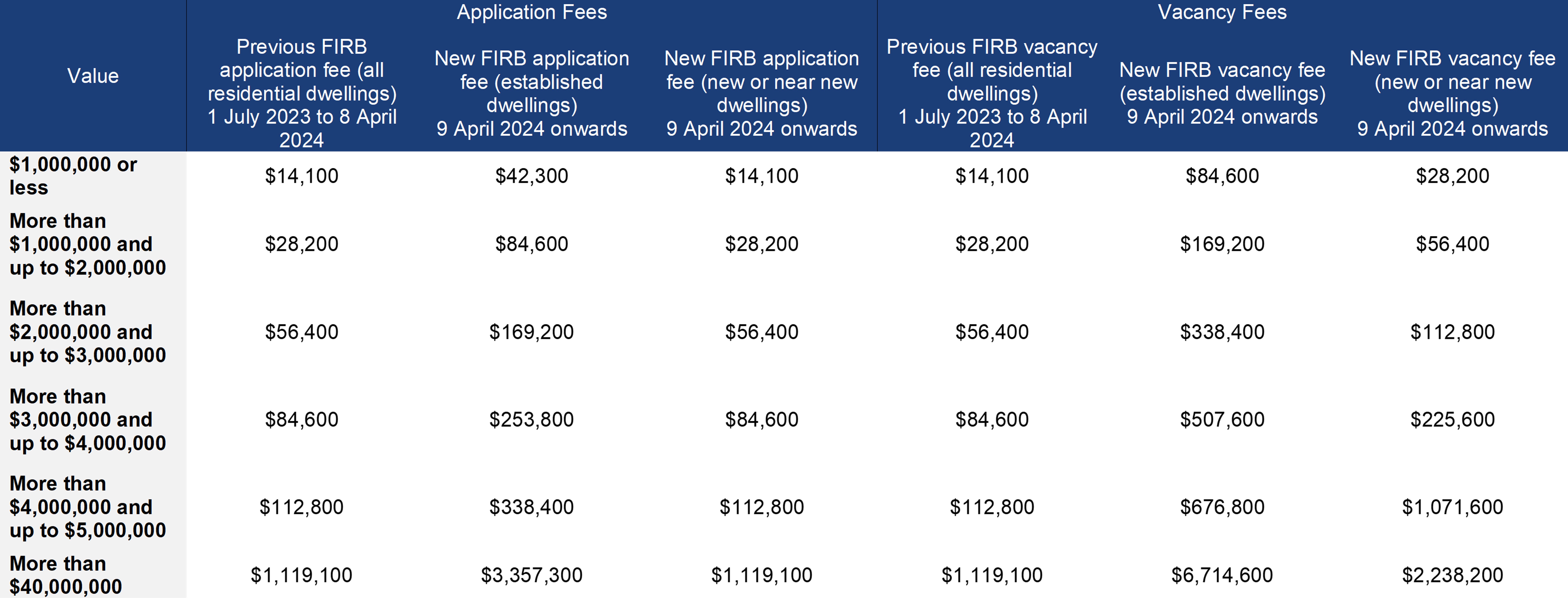

The application fee for foreign investors seeking to acquire an interest in Australian real estate is calculated based upon the value of the interest to be acquired. In addition, foreign investors who acquire a residential dwelling after 9 May 2017 must pay an annual vacancy fee if the dwelling is not occupied or genuinely available to rent.2 The relevant vacancy fee is determined with reference to the FIRB application fee.

On 8 April 2024, the Foreign Acquisitions and Takeovers Fees Imposition Amendment Act 2024 (Cth) (Amending Act) received Royal Assent. The Amending Act amends Australia’s foreign investment law to:

The changes introduced by the Amending Act, and discussed in further detail below, took effect on 9 April 2024.

The intention of the Amending Act is to encourage foreign investors to invest in new housing developments (rather than existing housing stock) to create additional housing stock and support economic and jobs growth (for example, in the construction industry). In combination, the changes to the initial application fees and vacancy fees from 9 April 2024 have the effect of increasing annual vacancy fees by 600%, with the intention being that foreign acquirers of existing housing stock are disincentivised from permitting those properties to remain vacant for extended periods of time (and encouraging them to make those properties available to renters).

For example, from 9 April 2024:

As annual vacancy fees are calculated with reference to the FIRB application fee, from 9 April 2024:

The table set out below provides a breakdown of the application fees and annual vacancy fees that previously applied and those that apply as at 9 April 2024 for each acquisition value (noting annual indexation will apply in future).

It is not uncommon for foreign-owned property developers to purchase residential land that contains existing dwellings for the purpose of redeveloping the land into new housing stock (which includes housing under a ‘build to rent’ (BTR) scheme). This may include the acquisition of one or more existing residential dwellings, which are subsequently re-developed into mixed-use or high-density housing (such as apartments). Developers may accordingly hold residential land for several years (and therefore be subject to the imposition of vacancy fees until completion of the project and sale of the re-developed land).

The imposition of the high fees applicable to residential land can operate as a significant disincentive to foreign developers and investors which may have unintended consequences noting the challenges with affordable housing stock in Australia.4 In this context, it remains to be seen whether the intention of the Amending Act will be achieved as:

The Treasurer has, however, specifically announced that the Federal Government intends to ensure that foreign investment application fees for BTR projects after 14 December 2023 are assessed at the lowest level (being the fees applicable to commercial land), regardless of the type of land that is actually involved. It remains to be seen whether any formal amendments of Australia’s foreign investment legislation will be implemented to achieve this objective, or if the fees will simply be waived or reduced on a discretionary basis under FIRB’s existing powers to do so.

On 1 May 2024, the Federal Government also announced its intention to implement further reforms permitting foreign investors to acquire established BTR developments (with the aim of encouraging additional investment in the sector), which we expect will be of particular interest to offshore institutional investors and real estate funds given Australia’s current rental market and BTR project pipeline.

The changes to Australia’s foreign investment regime were noted by Treasurer Chalmers to be part of the Australian Government’s ‘broad and ambitious’ agenda to improve housing affordability and supply, and the Amending Act was passed with bipartisan support. In the current context of historically low rental vacancy rates, high housing prices and the forecast and increasing divergence between new housing stock and the requirements for Australia’s forecast population growth, we expect that this will be an area of increasing focus for the Australian Government moving forward (supported by the policy reform announced on 1 May 2024).

Current and prospective foreign investors should be aware that the original announcement of the proposal to make the changes effected by the Amending Act on 10 December 2023 was accompanied by commentary from the Treasurer that the ATO’s compliance regime would be enhanced to ensure that foreign investors comply with the foreign investment regime, including selling their properties where required. Although we are yet to see specific legislative amendments in support of this announcement, we anticipate that this may be reflected in increased audit activity from the ATO and correspondingly in the issue of infringement notices.

FIRB is still in the process of updating its guidance to reflect the changes imposed by the Amending Act, and so it remains to be seen whether there may be any further policy overlay to how FIRB intends to apply the changes introduced by the Amending Act.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs