Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

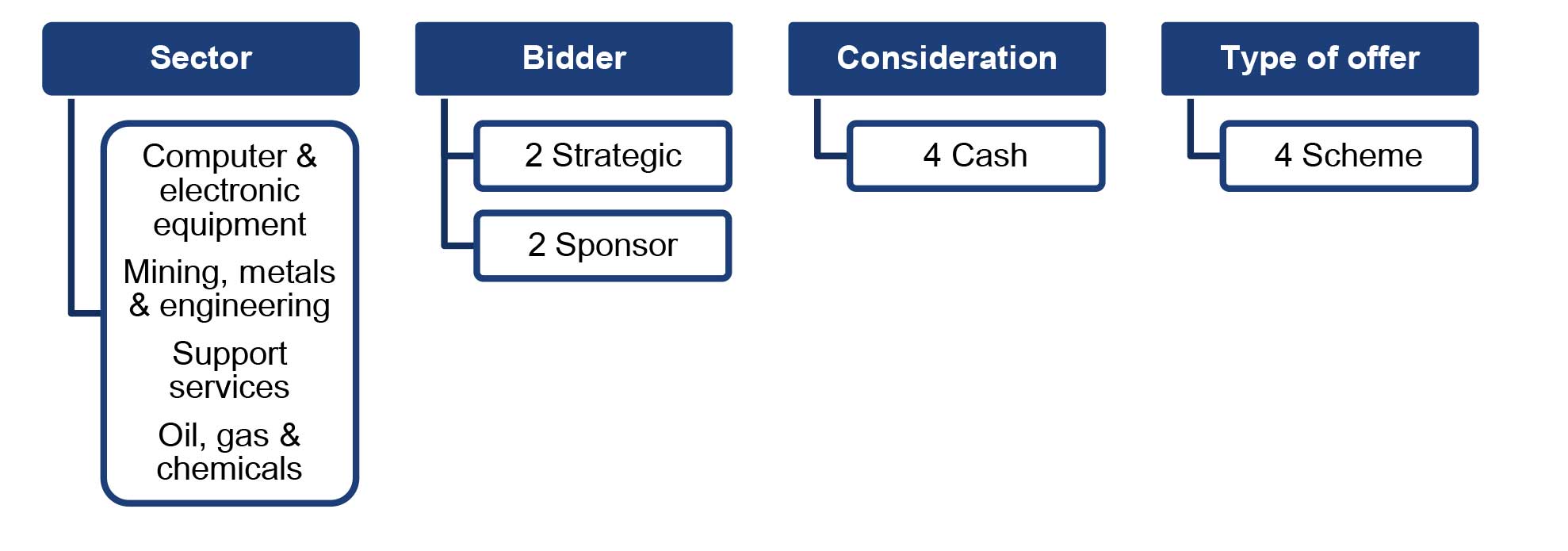

In June 2024, there were four Rule 2.7 announcements made across the UK public M&A market and seven further possible offers announced.

First Phase 2 investigation under EU FSR regime

The European Commission has opened its first in-depth (Phase 2) investigation under the EU Foreign Subsidies Regulation (FSR).

Under the FSR, M&A transactions need to be notified to and assessed by the European Commission before they can be implemented, where

The Commission said earlier this year that, since the regime came into force in mid-2023, it had engaged in pre-notification discussions in 53 cases, of which 14 were formally notified and 9 approved. It is thought that since then others have been approved following a preliminary Phase 1 investigation.

This is the first time a transaction has gone to a more in-depth Phase 2 investigation. The transaction concerned is the proposed acquisition by Emirates Telecommunications Group Company PJSC ("e&") of sole control over PPF Telecom Group. PPF runs telecom operations in Bulgaria, Hungary, Serbia and Slovakia. e& formally notified the proposed transaction to the Commission under the FSR on 26 April 2024. On 10 June 2024, the Commission opened its Phase 2 investigation on the basis that it considered there were sufficient indications that e& may have been granted foreign subsidies that distort the internal market.

This case is a useful reminder to M&A parties and practitioners to assess early on in a transaction whether the regime might apply (bearing in mind that the threshold for notification is referenced to "foreign financial contributions" – which could include arms' length payments for goods or services – not just subsidies) and factor it into the timetable and transaction planning as necessary.

For more detail, see our Competition, Regulation and Trade blog post here.

Latest HSF public M&A podcast

In the latest episode of our public M&A podcast series, we discuss Panel Bulletin 7, which sets out the Panel Executive’s approach to bidders’ intention statements on an offer. In the podcast we talk about:

To listen to the full conversation please visit SoundCloud, Spotify or iTunes.

We also discuss the Panel Bulletin in our blog post here.

All episodes in our UK public M&A podcast series are available on our public M&A podcast page.

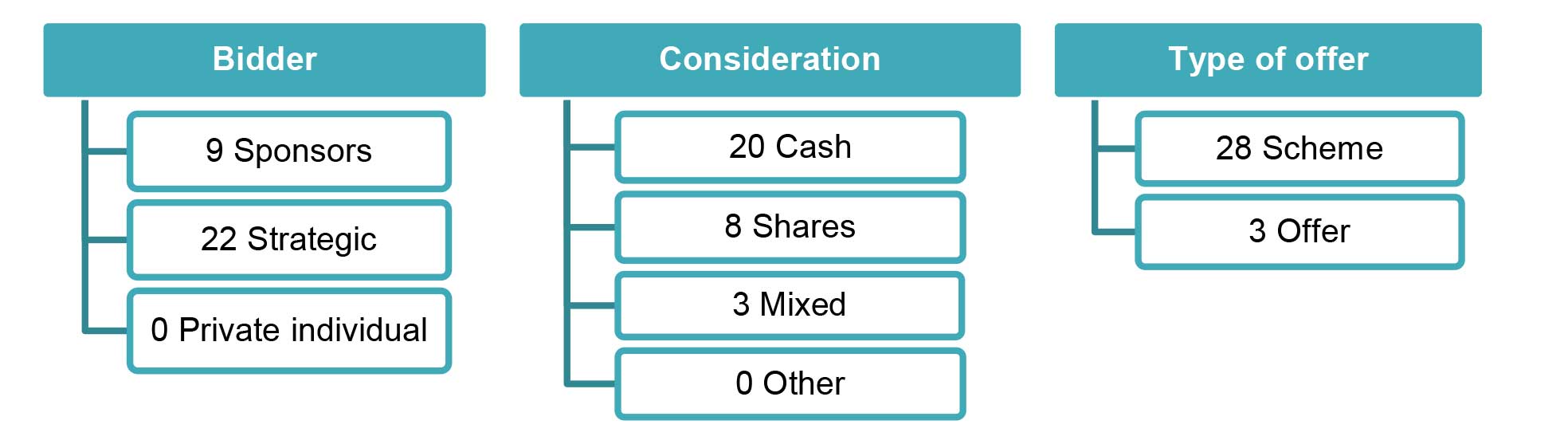

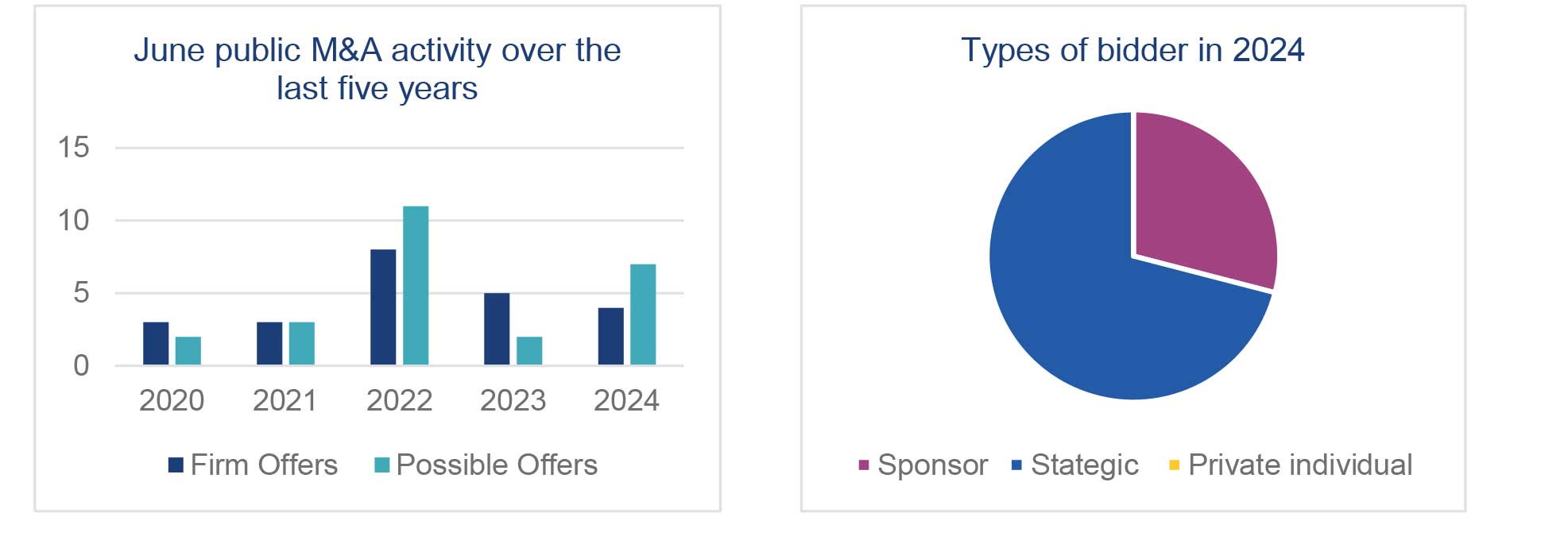

The number of Rule 2.7 announcements made in June 2024 has decreased compared to the previous two years, with the announcement of four firm offers. By contrast, seven possible offers were announced in June 2024 which is a significant increase compared to June 2023. The trend of competitive situations continues, with Checkit plc and Ideagen Limited making competing possible offers for Crimson Tide plc. Interestingly, for the first time in 2024, the two bidders were considering offering different forms of consideration – Checkit's possible offer inclued share consideration whereas Ideagen's possible offer involved cash consideration. Whilst Checkit has now confirmed that is does not intend to make a firm offer for Crimson Tide, it remains to be seen whether Ideagen will make a Rule 2.7 announcement. We discussed competing takeover offers in a recent podcast which you can listen to here.

In 2024 so far, only 29% of firm offers have been made by sponsor bidders compared to 42% across 2023. Conversely,strategics were behind 47% of firm offers in 2023 compared to 71% in 2024. This increase in the number of strategic bidders may be due to companies looking to use M&A as a growth strategy.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs