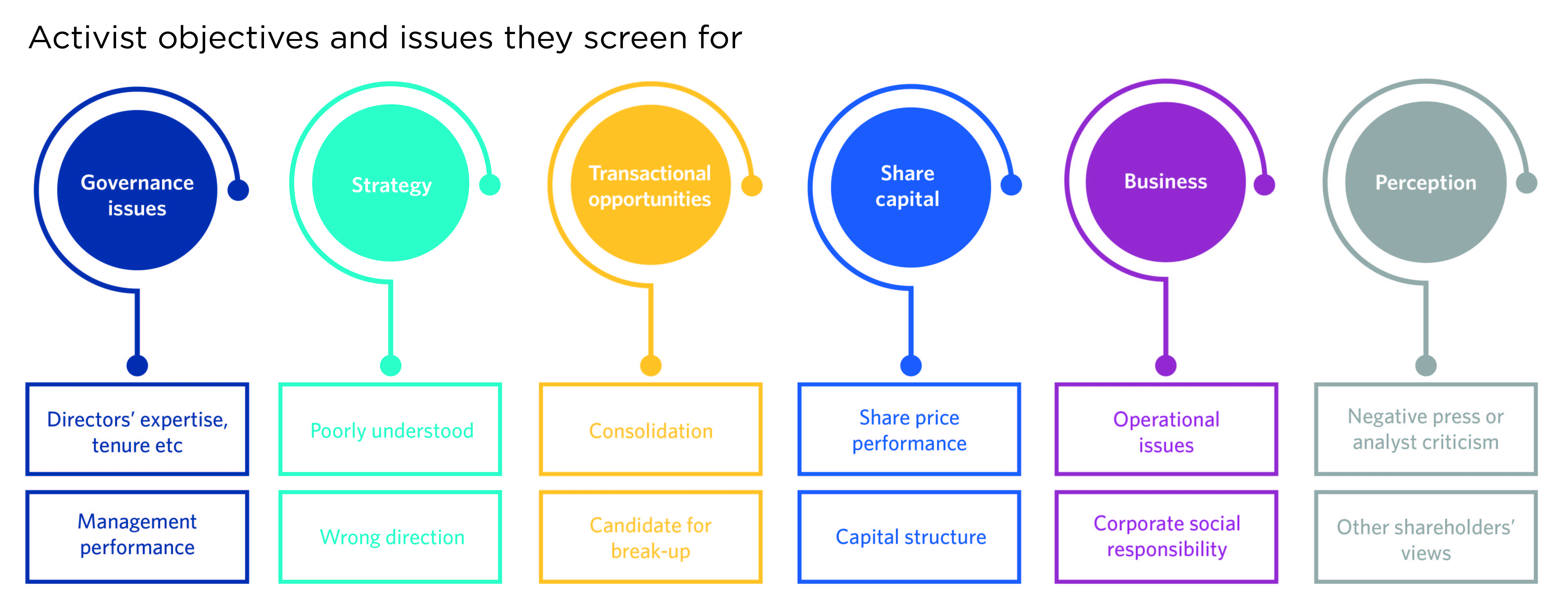

Activism is entrenched in the US and UK and growing globally. Shareholder activism comes in many forms, including engaging privately with a company on a particular governance issue, seeking to change some or all of a company’s board of directors or publicly calling for a company to undergo a transformational change, for example by way of M&A.

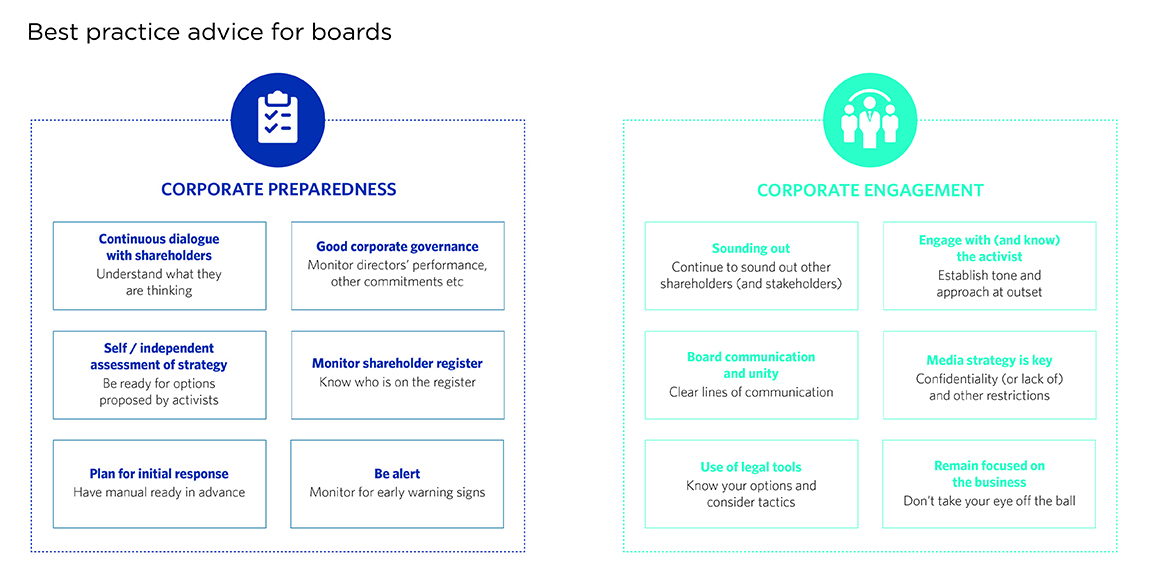

Companies need to be prepared for an activist approach. Activists' campaigns are no longer confined to smaller companies in general difficulties – no company is now viewed as being too large to target.

Companies are often well prepared for hostile takeovers, but less so for an activist campaign, which in many cases is the far more likely scenario. As well as seeing more companies preparing for an activist approach, we are also seeing a change in the typical response of the board of a company that is targeted, away from straight defence tactics alone and towards constructive engagement.

We can advise companies on what they should do to prepare for and deal with any activist that appears on their shareholder register, as we have strong expertise and experience in this area.

Featured

Recent insights

Shareholder Activism Podcast

Barbarians reborn: Can private equity transform impact investing?

UK shareholder activism in 2022 and beyond – What you need to know

Shareholder activism in Australia: Back bigger and bolder as ESG and transactional activism look to converge

Active Shareholders: Influencing deals remains front-of-mind for interventionist investors

The Shareholder Rights and Activism Review - Edition 4 - Australia

The Shareholders Rights & Activism Review – Edition 4 - United Kingdom

Shareholder activism update 2019

Shareholders activism focuses on privacy issues

Investors — shareholders as key players

The activist’s tools and playbook

The Shareholder Rights and Activism Review, 3rd edition

Explore all sub topics