IP Australia’s annual Australian IP Report presents insights and developments in intellectual property, including trends in Australia’s IP landscape, based on statistics and research from the administrator of Australia’s IP system and associated bodies.

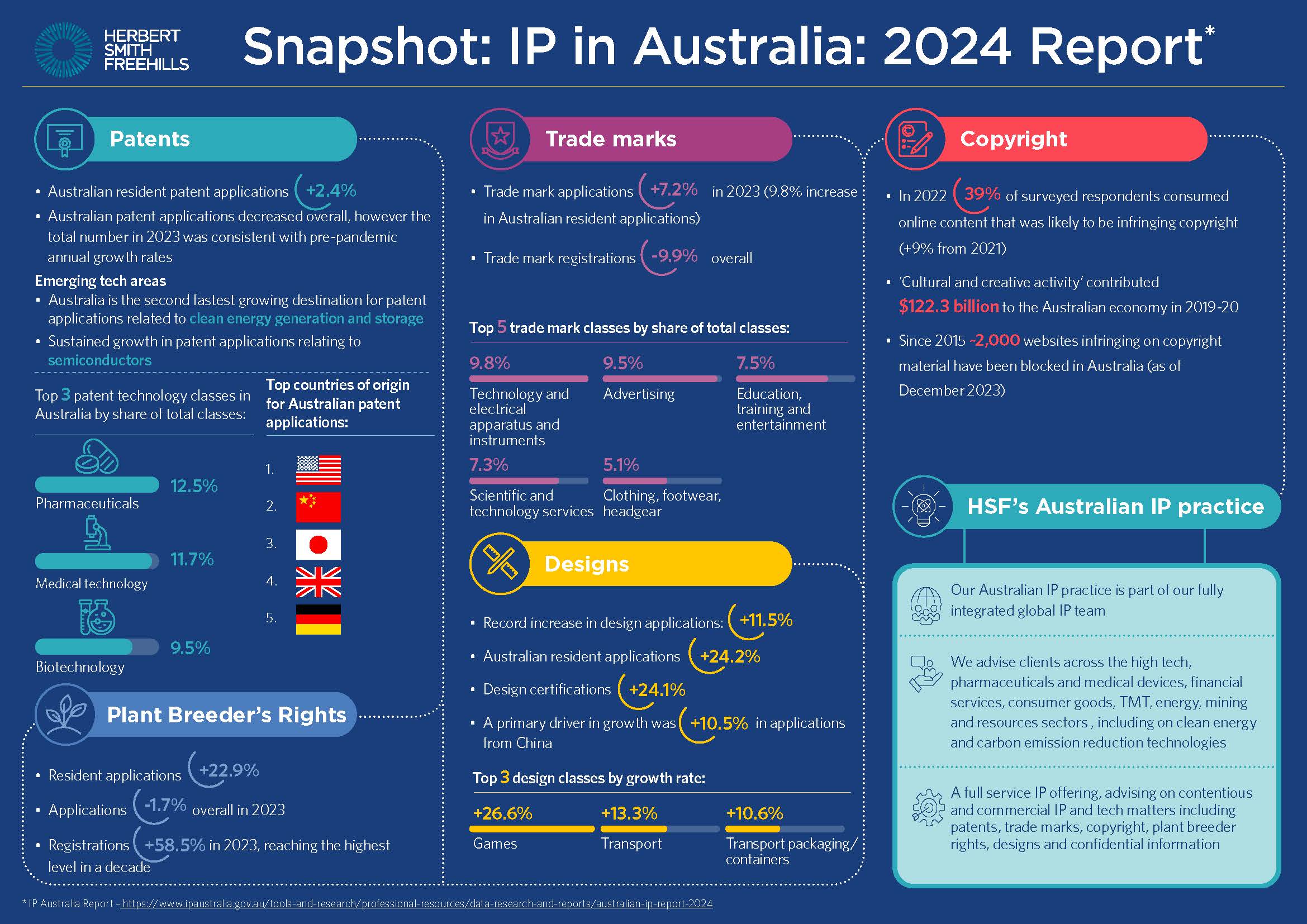

HSF’s handy infographic summarises some key points emerging from the 2024 iteration of the report.

Key takeaways

- Australia is a growing market for technologies that are the focus of strategic competition between countries (eg semiconductors) and for other technologies for which Australia is a key destination market (eg clean energy technology). This highlights the importance for companies of securing IP rights by registration in Australia for these critical technologies and also of ensuring freedom to operate for companies looking to utilise these technologies.

- Technology is a driving force for companies across multiple IP classes in Australia, with growth in patents, trade marks and designs for technology sub-categories including electrical equipment and medical technology.

- Life sciences remain a leading source of innovation in Australia, in particular for patents relating to pharmaceutical, medical technology and biotechnology subject matter.

- Post-pandemic growth in the above areas (in particular compared to pre-pandemic figures) exemplifies the strength of Australia’s IP system, in particular the system of registration as a means of securing IP rights. Companies should be particularly conscious of possible IP generated in these areas.

Trends of note

- Clean energy generation and storage: Among 19 major economies, Australia is the second fastest growing destination for patent filings related to clean energy generation and storage. This rapid growth reflects the role innovation will play in helping to facilitate Australia’s shift to a low-carbon economy, and increasing commercial investment in the development of new technologies to enable this process.

- Semiconductors: Current trends indicate a sustained growth in patent filing in Australia related to semiconductors. There is significant international competition in the semiconductor industry, and the continued growth in patent filings reflects Australia’s healthy position as a market for innovation and as a destination market where IP protection is critical.

Patents

- In 2023 Australian patent applications fell 2.4% overall from 2022 levels, following record post-pandemic growth, but the number of total applications was consistent with expected rates of growth on pre-pandemic numbers.

- There was also a 2.4% increase in patent applications filed by Australian residents.

- Australia saw strong growth in patents for electrical machinery and apparatus. Chinese design filings for electrical equipment also nearly doubled (further insights on Designs are set out below).

- Despite the growth in the clean energy, semiconductor and electrical machinery and apparatus classes, life sciences continues to be a leading source of innovation. The top 3 patent technology classes by share of total classes were all in the life sciences sector: Pharmaceuticals (12.5%); Medical technology (11.7%) and Biotechnology (9.5%).

- The United States continues to be the leading country of origin for Australian patent filings, followed by China, Japan, United Kingdom and Germany.

Trade Marks

- Whilst trade mark applications increased by 7.2%, including 9.8% for Australian residents in 2023, trade mark registrations fell by 9.9%.

- The top trade mark class for applications in 2023 by share of total classes was Technology and electrical apparatus and instruments (9.8%), followed by Advertising (9.5%) Education, training and entertainment (7.5%); Scientific and technology services (7.3%); and Clothing, footwear, headgear (5.1%).

Copyright

- Consumption of online content that was likely to be infringing copyright increased in 2022 (39% of surveyed responders, up 9% from 2021), however this increase is at least partly attributable to the underlying survey’s increased ability to detect emerging methods of unlawful consumption.

- Around 2,000 websites have been blocked between 2015-2023 under Australia’s website blocking scheme in the Federal Court.

Designs

- Design applications rose 11.5%, marking a record high. Applications by Australian residents rose 24.2%, focused on design inputs to building and construction.

- Design certifications were also up over the period, increasing by 24.1%.

- A primary driver in growth was a 10.5% increase in filings from China. Filings from applicants based in China nearly doubled in designs for electricity production, transformation and distribution, as patents grew strongly in this field.

Plant Breeder’s Rights (PBR)

- Applications for PBR fell 1.7% overall in 2023, however resident applications increased significantly by 22.9%.

- There was a decline in applications for fruit crops, however a corresponding increase in applications for ornamentals (the first increase in this class since pre-pandemic in 2019)

- Registrations increased 58.5% in 2023, reaching the highest level in a decade. Registrations by residents more than doubled compared to 2022. IP Australia observed that this increase is largely attributed to the resumption of field examinations that had previously been suspended by the COVID-19 pandemic

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.