Infrastructure and energy projects connect and power our economies, creating growth opportunities for developed and emerging markets alike.

We understand the challenges that project participants face across the entire spectrum of developing and financing projects.

We work with our clients to develop innovative project financing structures and solutions. Our role as trusted advisers goes beyond simply advising on the financing of a project and extends to strategic advice and analysis, contract negotiation and the structuring, planning and documentation aspects of transactions.

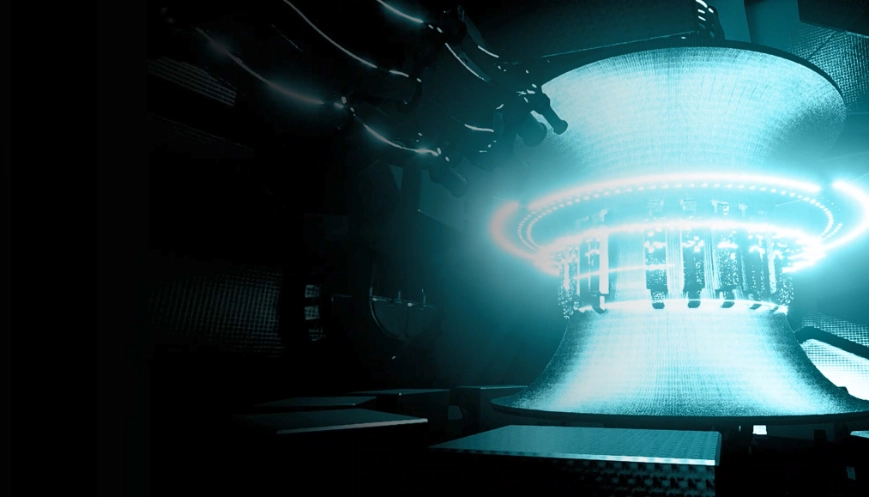

Our sector specialists can advise you on projects across energy, natural resources and infrastructure, including market-leading rail and road projects, the most complex power projects globally (eg the largest nuclear and most innovative renewables projects), LNG financings and transactions across the LNG value chain, and the largest reserve-based lending, structured commodity and upstream oil and gas project financings.

Our global team is at the forefront of developing innovative multi-source project financing structures and solutions including project bond financings, working with lenders, ECAs/DFIs, sponsors, governments, trading houses and other project participants.