Ready for takeoff:

The Australian ECM Review 2024

With 26 IPOs in 2024, a low since we started collecting IPO data in 2016, it might seem overly optimistic that we have titled this publication Ready for Takeoff. With persistent high inflation, geopolitical events and ongoing economic uncertainty, the Australian IPO market as a whole was muted for a third year in a row.

However, whilst still below long-term averages, capital raised on listing bounced back strongly in 2024 and is now at its highest level since 2021, both per IPO and in aggregate. The aggregate market capitalisation of new listings also recovered in 2024, almost doubling 2023’s total. These figures were assisted by what we are hopeful is the beginning of a recovery in new listings with a market capitalisation of more than $1 billion on listing.

Further, the raw figures do not include the year’s biggest listing, DigiCo Infrastructure REIT (as REITs are excluded from our data set). DigiCo Infrastructure REIT raised close to $2 billion, the most raised through an IPO since 2018. Herbert Smith Freehills acted for DigiCo Infrastructure REIT on this IPO. If included in our data set, capital raised by market capitalisation and capital raised per IPO would be higher than or on par with 2019 and 2020 levels.

The figures also obscure the excitement that followed the listing of Guzman y Gomez, solid sector representatives in Tasmea (engineering services), MAC Copper (metals and mining) and Cuscal (payments and regulated data services) and the spate of sought after private credit listings (LITs and ETFs are excluded from our data set).

Ultimately, stronger aggregate results despite a decrease in the total number of IPOs in 2024 together with the success at the top end of the market have given us enough hope to believe that IPOs are ready for takeoff.

Number of IPOs 2018-2024

Capital raised by market capitalisation and per IPO 2018-2024

Market capitalisation, capital raised and number of IPOs in 2024

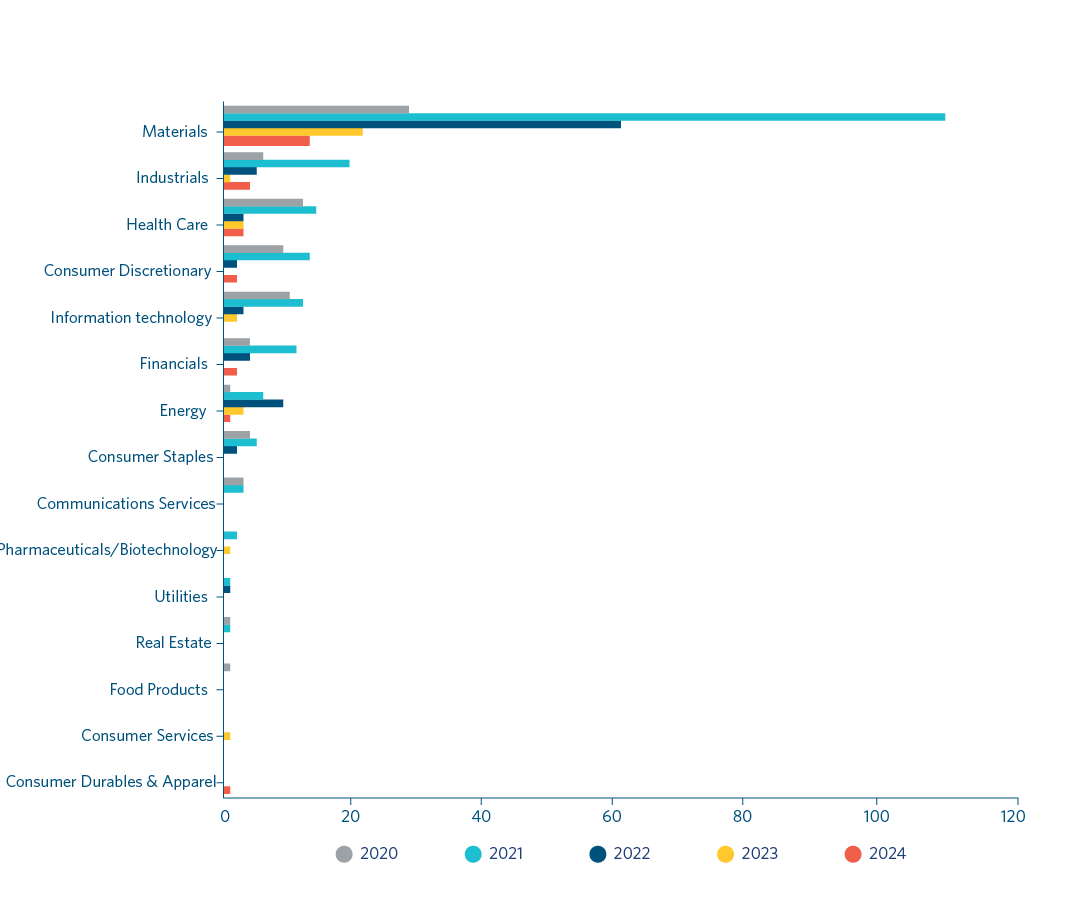

Whilst the materials sector was once again the dominant sector for new entrants to the ASX (approximately 50%), a significant contributor to the low number of IPOs in 2024 was the continued decline in materials IPOs.

Industrials-based listings comprised the next most represented sector by number (~15%). These included construction company Symal Group, mining equipment firm Alfabs Australia, maintenance specialist Tasmea and marine services company Bhagwan Marine.

IPOs in the Consumer Discretionary and Financials sectors returned to the charts in 2024 following absence in 2023, and the Merino & Co IPO heralded the first listing by a Consumer Durables & Apparel-based company in several years. There were no IPOs in the Information Technology sector in 2024.

IPOs by sector 2020-2024

Given the dominance of the materials sector, we have also replicated the graph on the following page which excludes the materials sector to more clearly show the trends in other sectors from 2020 to 2024.

IPOs by sector 2020-2024 (excluding materials)

-01.2025-02-24-05-20-15.png)

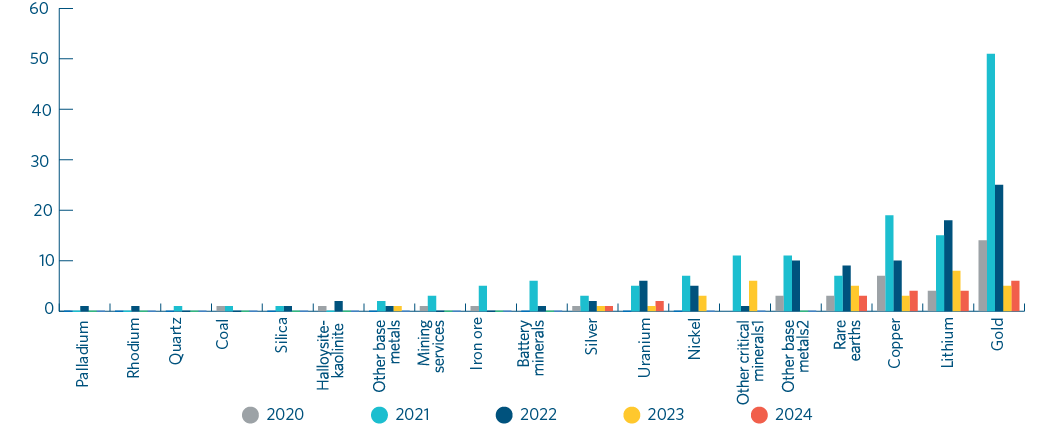

IPOs from the ‘materials’ sector 2020-2024

Within the materials sector, IPOs were once again spread across a number of metals, including strong representation from gold (30%), copper (23%) and lithium (23%) miners/explorers. We have charted below the breakdown of IPOs from the materials sector from 2020 onwards.

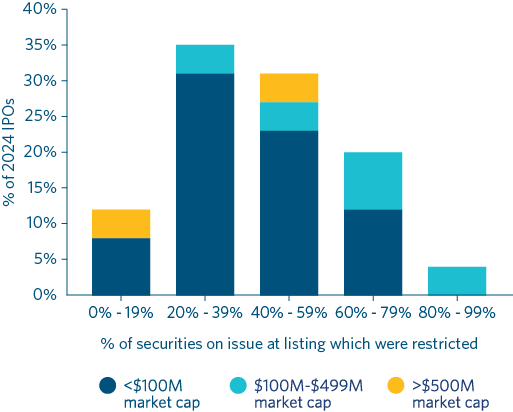

Reflective of the continued headwinds for IPOs in 2024, the average number of ordinary securities subject to escrow remained higher than long-term averages at 43% of total outstanding ordinary securities, whether imposed by the ASX or voluntarily restricted by the issuer. Although marginally lower than in recent years for issuers with a market capitalisation of over $250 million, we are hesitant to draw conclusions from this change as two of the larger IPOs in our data set were Webjet Group (the result of the demerger of Webjet, an entity listed on ASX) and Metals Acquisition (an entity listed on NYSE), both of which did not impose any form of escrow (as is more typical for entities with established trading histories).

Issuers with a market capitalisation of less than $100 million most frequently escrowed 20-40% of their ordinary securities, while issuers with market capitalisations of $100 million or more tended to adopt higher ranges of escrow, from 40-80%. Guzman y Gomez, the largest listing of the year, had approximately 55% of its ordinary securities in escrow. Escrow was typically released in two tranches. See below in relation to escrow periods and release.

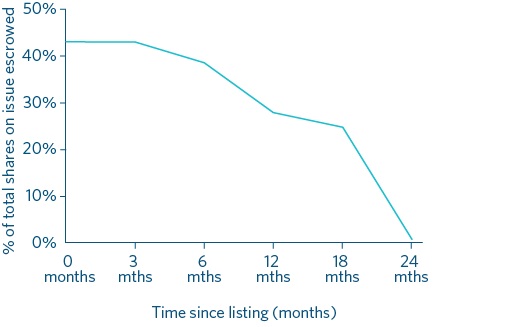

Timing of Escrow Release

Every IPO in this segment scheduled the release of restricted securities in between one to four tranches. Those tranches were most commonly timed from the date of quotation, but in some circumstances expired in line with the release of subsequent financial results. In one case, Kali Metals, some of the escrowed securities had an early release mechanism if the daily volume weighted average price of Kali Metals shares exceeded a certain price for a period of ten consecutive trading days. Kali Metals is a lithium focused exploration company that listed on ASX with a market capitalisation of $36 million. All restricted securities were scheduled to become unrestricted within 24 months of the listing date.

The average release profile of IPOs is set out below.

Average restricted security release profile 2024 IPOs

The release of Guzman y Gomez’s shares was scheduled to occur in two tranches – one after six months (which represented ~14% of total shares on issue), and another after 12 months (which represented ~41% of shares on issue).

Among the seven other issuers with a market capitalisation of $100 million or more, as referenced above, two did not escrow any securities (Metals Acquisition and Webjet Group), and three are scheduled to release their escrowed securities in one large tranche (Cuscal, Symcal Group and Bhagwan Marine). Vitrafy Life Sciences had the largest volume of restricted securities on issue, at ~68.1%. These were released in 4 tranches: ~19% after 6 months, ~3% after 12 months, ~51% after 18 months and ~22% after 24 months.

Restricted securities by market capitalisation

The percentage of underwritten IPOs fell slightly in 2024 as compared to 2023, decreasing from 25% to 19% of all IPOs. For issuers with market capitalisations over $100 million, the percentage underwritten fell from 75% to 62.5%.

These figures are within the longer term expected range for underwritten amounts and consistent with our findings in relation to escrow, the inclusion of Webjet Group and Metals Acquisition in our data set (both non-underwritten) has influenced these figures.

Percentage of all IPOs underwritten 2024

Percentage of underwritten IPOs over $100M market capitalisation 2018-2024

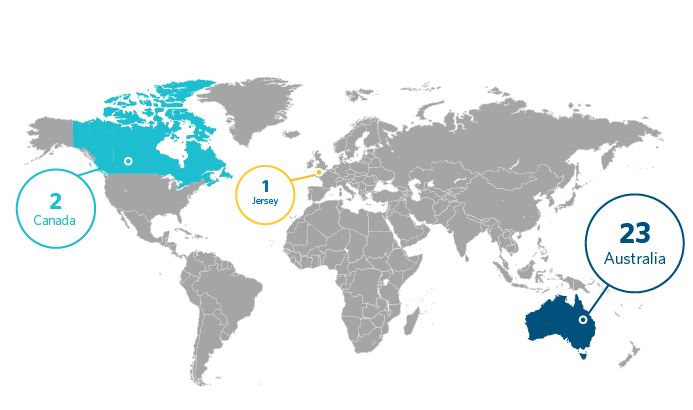

2024 was dominated by Australian-incorporated issuers, with 88% of IPOs by number coming from the domestic market. Canada (Golden Horse Minerals and Resouro Strategic Metals) and Jersey (Metals Acquisition) represented the only foreign jurisdictions to contribute new listings to the ASX. While Metals Acquisition, the second largest IPO of 2024, is incorporated under the laws of Jersey, it owns and operates CSA Copper Mine in Cobar, New South Wales.

Jurisdiction of issuer incorporation 2024

Footnotes

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs