Ready for takeoff:

The Australian ECM Review 2024

We have also compared secondary raising activity in 2024 to 2023, with the data generally showing increased activity in secondary raisings both by number and value in 2024 (82 transactions raising $17.54 billion) as compared to 2023 (44 transactions raising $12.77 billion).1

Readers of the 2023 Review will recall that the 2023 Review covered transactions in excess of $50 million ($50 million Threshold). In the 2024 review, our threshold has been lowered to $10 million to capture a larger segment of the market and generate a broader data set. This article now analyses data collected on well over 200 secondary raises that occurred in 2024. Comparisons between 2024 and 2023 in this article are only performed for those transactions in 2024 over the $50 million Threshold to ensure an ‘apples with apples’ comparison.

In addition to the transactions considered for the 2023 Review, the transactions analysed for the purposes of this article were transactions listed on Connect4 as at 17 January 2025 as having occurred in 2024. We supplemented Connect4 data with analysis of the relevant transaction announcements. We have excluded non-share/non-CDI secondary raisings, capital notes transactions and strategic placements on the basis that these contain features not normal to a ‘standard’ equity capital raising which would skew our data set.

In 2023, the combined placement and SPP was the most popular offer structure by number of transactions (42%), followed by the combined placement and rights issue (22%) and standalone placement (16%). In 2024 for deals over the $50 million Threshold, the standalone placement was the most popular offer structure (33%), followed by the combined placement and SPP (32%), then the combined placement and rights issue (23%).

Of the rights issues analysed, all adopted an accelerated non-renounceable entitlement offer (ANREO) structure, excluding four renounceable offers undertaken by Hastings Technology Metals Ltd, AMA Group Ltd (both a combined AREO and placement) and Energy Resources of Australia Ltd and Legacy Iron Ore Ltd (both a standalone AREO).

As expected, standalone placements were the dominant form of offer structure for transactions below the $50 million Threshold, making up 57% of transactions. While we did not gather data on these transactions for the 2023 Report, this is consistent with our experience - issuers at the lower end of the market tend to require more immediate and lower cost equity funding, may have a lower retail component on their register and can often rely on the enhanced placement capacity under listing rule 7.1A.2 Inclusion of a retail component in their offers may increase the cost of undertaking the offer substantially for little additional capital raised with the result that it is less economical than inclusion of a retail offer for larger issuers. Looking at it with a different lens, whereas in larger transactions a placement is often accompanied with an SPP, this is not the case for transactions below the $50 million Threshold.

Offer type (over $50 million Threshold in 2024)

Offer type (over $50 million in 2023)

Offer type (between $10 and $50 million)

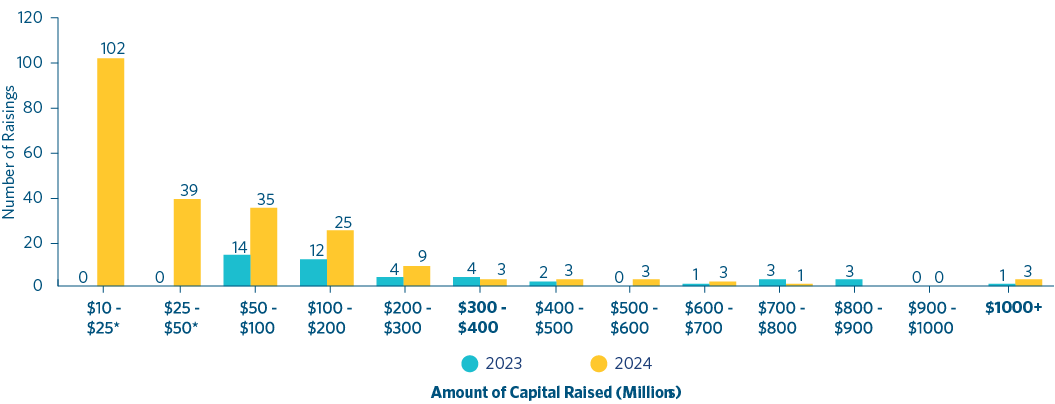

The distribution of offer sizes in 2024 indicated an increased appetite for deals in general when compared to 2023, with more transactions occurring in 2024 in most of the size categories set out below. While not surveyed in 2023, in 2024, as expected the highest proportion of transactions occurred in the $10 million to $50 million range.

Offer size

* Data not not gathered in 2023.

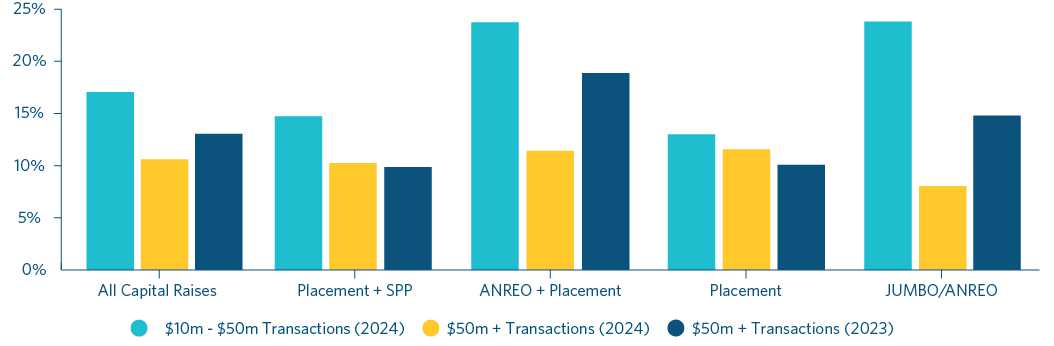

Discount levels contracted slightly in 2024, reflecting a more bullish market relative to 2023. The average discount to the last closing price decreased from 13.04% in 2023 to 10.60% in 2024 for transactions over the $50 million Threshold. This possibly is reflective of the greater proportion of transactions in 2024 that were undertaken by placement (as discussed further above).

Among specific offer types, ANREO and Placement deals saw the highest average discount across the board, with a 23.73% average discount in the sub-$50 million category, while above the $50 million Threshold this offer structure recorded a 11.41% average discount, a decrease from the 18.87% seen in 2023. JUMBO/ANREO transactions exhibited the most significant variation, with transactions below the $50 million Threshold exhibiting an average discount of 23.80%, whereas transactions above the $50 million threshold had a much lower discount of 8.03%,4 a significant drop compared to the 14.79% average for comparative transactions in 2023. Interestingly, average discounts for Placement and SPP transactions remained relatively stable between 2023 and 2024, with an average discount of 10.24% for transactions over the $50 million Threshold, closely aligned with the 9.87% observed in 2023 (for transactions below the $50 million Threshold, the average discount was 14.73%).

Average discount to last close

One of the findings we were surprised by in our 2023 Review was the lack of correlation between transaction value and the discount, as in our experience the size of a transaction can be indicative of the strength and size of the underlying business and stronger businesses are usually able to command tighter discounts from investors. It is worth noting that this is a general observation and the discount of a given transaction is ultimately determined by a range of considerations in addition to the financial position of the underlying business, such as market dynamics and the structure of a raise.

By contrast to our findings in the 2023 Review, a clear distinction emerged in the data between discount rates for smaller and larger transactions, predominantly due to lowering of our threshold to capture transactions raising under $50 million. Transactions in the $10 million - $50 million range exhibited higher average discounts across all offer types, with an overall average discount of 17.04%, compared to 10.60% for transactions exceeding $50 million in 2024.

The tighter discounts in 2024 in our review of were also reflected in discounts to the theoretical ex-rights trading price (TERP) for rights issues, with discounts again contracting from 13.11% in 2023 to 9.85% in 2024 for transactions over the $50 million Threshold.

Offer price (discount to TERP)

Offer price (discount to last closing price)

Interestingly, the proportion of transactions being undertaken for M&A vs non-M&A purposes increased for transactions above the $50 million Threshold when comparing 2023 to 2024, with 23.8% of transactions in 2024 being undertaken to fund M&A transactions,5 as compared to 17% in 2023. This is consistent with our predictions in the 2023 Review of the market being supportive of M&A transactions.

Practically, these transactions need to be funded either by cash or scrip, and where cash is the preferred option, either by equity or debt issuance. Given the high interest rate environment – at least relative to the historic COVID lows – we are unsurprised in the increased use of equity raisings to support M&A transactions and expect this trend to continue into 2025, subject to further declines in interest rates.

Purposes of capital raising (M&A and Non M&A)

Purposes of capital raising by transaction size

When comparing the data on offer pricing relative to offer purpose (including for transactions under the $50 million Threshold), we observed that, on average, issuers offered a smaller discount to last closing price when seeking to fund an acquisition (10.01%) in contrast to raising for non-acquisition purposes (15.50%). This is consistent with our findings in 2023.

2024 showed a slight decline in fully underwritten deals compared to 2023. The data suggests that issuers are increasingly opting for partially underwritten or non-underwritten structures to reduce costs. In 2023, 80% of offers over the $50 million Threshold were underwritten, compared to 58% in 2024. This may be because of the increased prevalence of placements in 2024 as compared to 2023 (placements tend to be underwritten less often than entitlement offers due to the increased level of certainty that issuers have over pricing and the amount of capital that will be raised). The lower prevalence of underwriting was seen particularly in the lower end of the market, as expected, with only 24.1% of the transactions below the $50 million Threshold being underwritten.

Underwritten vs. Non-Underwritten transactions

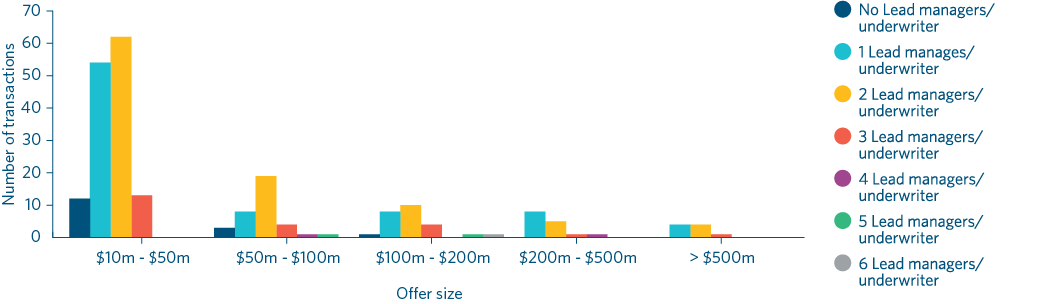

Consistent with our data set for 2023, we did not notice any particular correlation between raise size and number of lead managers / underwriters on the transaction.

Number of Lead managers/underwriters per transaction relative to offer size 2024

Also consistent with our findings in 2023, for combined placements and SPPs, generally only the placement was underwritten, consistent with our observation of usual market practice. This is likely because issuers are usually not particularly reliant on funds raised via SPPs (which as mentioned above are capped at $30,000 per shareholder under relevant law and are usually used as a fairness measure to retail shareholders) and due to the enhanced underwriting risk for an SPP (given the length of time an SPP is open and the nature of the investors).

In terms of fees, the average underwriting/management fees as a percentage of offer size remained broadly stable at 3.20% in 2023 and 3.30% in 2024 for transactions over the $50 million Threshold, with slight variations depending on deal size and complexity.

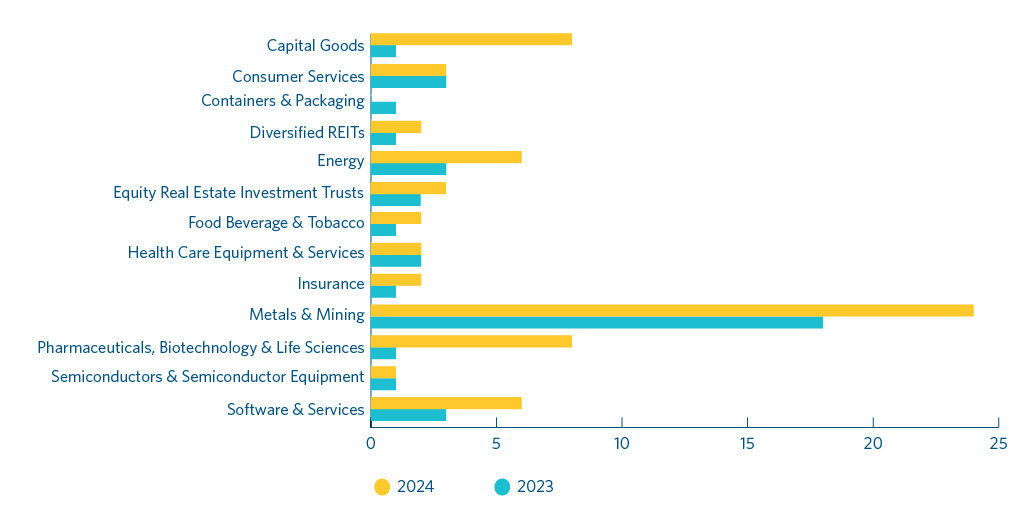

Underwriting/Lead manager fees plotted against transaction size

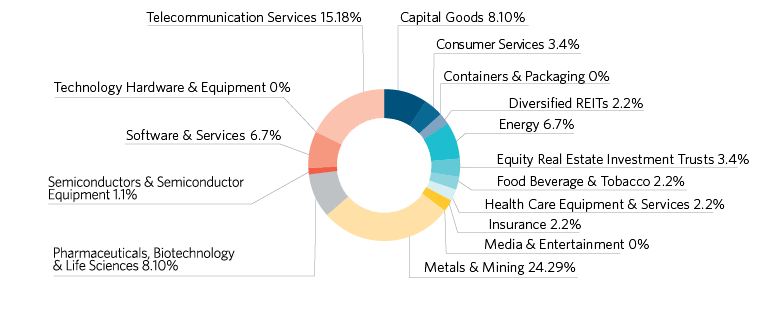

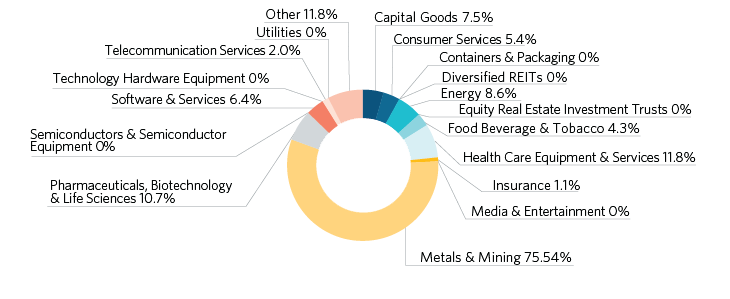

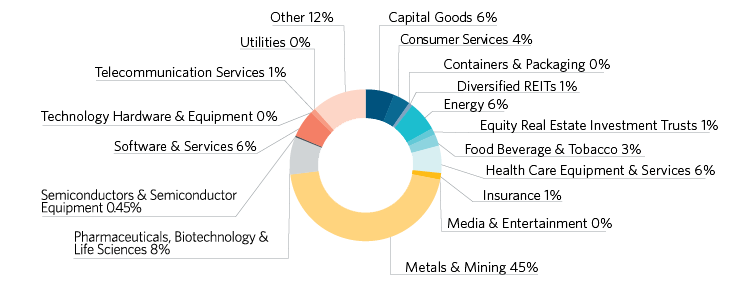

As anyone familiar with the ASX would expect, the Metals & Mining sector maintained dominance in our data set both by number of transactions (100) and total capital raised ($4.93 billion). Metals & Mining transactions exceeding the $50 million Threshold accounted for 30.49% of all deals in 2024, with 25 transactions raising $3.55 billion in aggregate, compared to 18 transactions in 2023 (raising $3.385 billion), highlighting sustained investor interest in resources stocks, including those exposed to critical minerals and energy transition projects.

The Software & Services segment experienced notable growth, securing $2.28 billion across six deals, a significant increase from three deals in 2023, driven by demand for digital transformation and enterprise software. The size of these transactions was somewhat skewed by two secondary raisings undertaken by NextDC, which combined accounted for 90% of the total capital raised ($1.99 billion) in this sector.

The Pharmaceuticals & Life Sciences sector saw a substantial uptick, with eight transactions raising $973 million in 2024, compared to just one deal in 2023, signalling growing interest in healthcare innovation and life sciences.

The Energy sector remained strong, raising $1.46 billion across six deals in 2024, up from three deals in 2023, reflecting continued investment in renewables and traditional energy projects.

Overall, 2024 saw a shift toward larger transactions across diverse sectors.

Sector analysis - number of transactions over $50 million (2023 vs 2024)

Transactions over $50 million (2024)

Transactions between $10 million and $50 million (2024)

All transactions (2024)

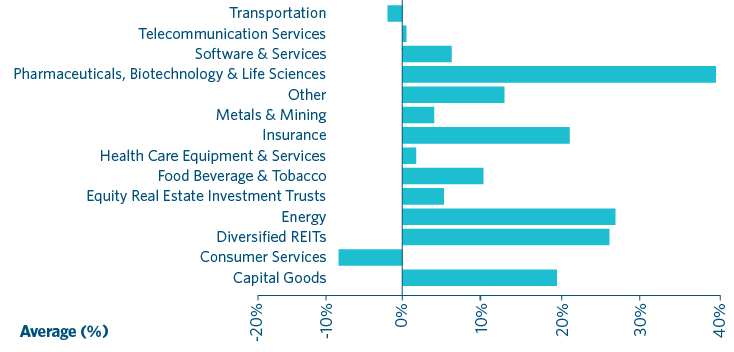

This year, share price performance 30 days post-allotment6 was captured as a new data point. Post-raise performance varied significantly across industries, with certain sectors outperforming while others faced downward pressure. Sectors such as pharmaceuticals and energy showed strong returns, which may have been driven by continued investor confidence and favourable market conditions. In contrast, sectors like consumer services and transportation struggled post-raise, which may reflect broader economic challenges and sector-specific headwinds.

The strong performance in pharmaceuticals and biotechnology stocks can be attributed to sustained demand for innovation and healthcare solutions, whereas energy sector growth was likely driven by favourable commodity prices and ongoing global demand. On the other hand, consumer services faced challenges due to inflationary pressures and increased cost of living, while transportation struggled with rising operational costs.

Post-raise share price performance by industry

ConclusionOverall, 2024 has presented a dynamic ECM environment, with increased activity across all areas of the market, a decrease in average discount levels, larger offer sizes and evolving underwriting trends. Companies have continued to leverage capital markets to fuel expansion, restructure debt, and pursue strategic growth. Additionally, shifts in sector focus and underwriting strategies provide further insights into changing market sentiment. As market conditions evolve, issuers and investors alike must remain agile in navigating the changing landscape. |

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs