The FCA has set out its expectations for asset management firms in a recent ‘Dear CEO’ letter (the Letter), confirming that such firms should be taking proactive steps now, and should be in no doubt that they have a “responsibility to facilitate and contribute to an orderly end to LIBOR”.

This letter follows on from the suite of documents published by the FCA and Bank of England (BoE), together with the Working Group on Sterling Risk Free Reference Rates (RFRWG) earlier this year (see our blog post for more information).

Next steps

Asset management firms should:

- Reflect on the messages and act – do not wait for instructions from clients. The FCA has noted that this is a market event and solutions will be market-led. Firms should not expect or base their transition plans on future regulatory relief or guidance or legislative solutions.

- Take immediate action to develop and execute an appropriate LIBOR transition plan where you have LIBOR exposures (if a transition plan has not already been prepared). This may include revising Senior Managers’ Statements of Responsibilities. Your transition plan must be board approved and supervised.

- Inform the FCA immediately if the Board considers that a barrier to transition is “insurmountable” or if preparations will not be completed in time.

- Monitor the FCA’s Transition from LIBOR’s webpage for further updates.

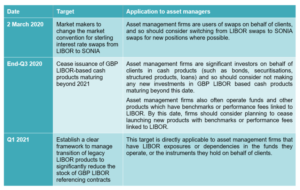

FCA, BoE and RFRWG targets have a “direct read across” for asset management firms

The papers published in January set out a series of targets over the course of 2020 (and early 2021) for banks and other relevant firms to meet to ensure the smooth transition from LIBOR. In the Letter, the FCA sets out how some of these targets apply to asset management firms.

It may be necessary to change the services and products offered

The Letter makes clear that firms will need to consider what products and services they offer their clients and how LIBOR may impact them.

For example, managing the transition for products such as funds, collective investment schemes and/or segregated mandates which reference LIBOR may involve offering new products that reference alternative rates; or amending existing products to include fall-back provisions or replacing LIBOR with alternative rates.

Where asset management firms invest in products which reference LIBOR, such as bonds, loans, swaps and structured products, firms may need to invest in different instruments, or engage with issuers and counterparties to convert outstanding instruments to alternative rates.

Senior management should be appropriately involved

The FCA and PRA wrote to banks in 2018 to ensure Senior Managers were identified who would oversee the implementation of the transition from LIBOR (Dear CEO Letter on firms’ preparations for transition from LIBOR to risk-free rates published in September 2018).

This Letter confirms that Senior Managers at asset management firms also need to have oversight of the transition process, and firms need to be clear on who has accountability for managing each aspect of the transition. Statements of Responsibility may need to be updated to include responsibilities arising from firms’ transition plans.

Even if firms have little or no LIBOR exposure, the FCA expects Boards to test this view periodically.

Firms must still manage conflicts of interest

The Letter makes clear that while transitioning clients from LIBOR, all clients should be treated fairly and should have their interests upheld throughout the process. Conflicts of interest must be mitigated or managed appropriately, and clients should not be exposed to unpredictable or unreasonable costs, losses or risks.

What to consider when preparing transition plans

The FCA considers that firms’ transition plans should be prepared across business functions, and based on engagement with wider transition efforts in the market. Firms will need to fully understand and quantify how their operations are vulnerable to LIBOR cessation (the FCA acknowledges that LIBOR is embedded in a wide range of systems), consider how LIBOR exposures can be addressed, and ensure that clients are kept updated.

Progress throughout execution of the transition plan should be monitored to ensure exposures are decreasing over time to meet the necessary targets.

Key contacts

Disclaimer

The articles published on this website, current at the dates of publication set out above, are for reference purposes only. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action.