Transactions

The value of everything

2024 saw an overall increase in deal value from $570 billion in 2023 to $780 billion. The increase in deal value was driven by activity and sizable deals in the US, although there was a decrease in deal numbers in 2024 globally when compared to 2023. The continued demand for digital transformation, the rise of AI, automation, cybersecurity and decarbonisation, combined with macroeconomic factors such as the US administration's focus on deregulation (which is likely to have a global ripple effect) and potential interest rate cuts by central banks worldwide, are expected to drive significant deal-making and investment in 2025.

From an overall TMT perspective, technology and AI emerge as the main drivers of M&A activity in this sector. Numerous companies are making substantial investments in these areas, which are set to propel M&A activity. Significant activity in the US is forecasted to persist through 2025, as exemplified by Softbank's commitment to a $100 billion investment in the US over the next four years, focusing on technology and AI. Over in Asia, China is spearheading the technology M&A scene, bolstered by strong innovation and policy support for AI, alongside the pioneering introduction of DeepSeek's AI models. For more on AI and M&A see our AI piece.

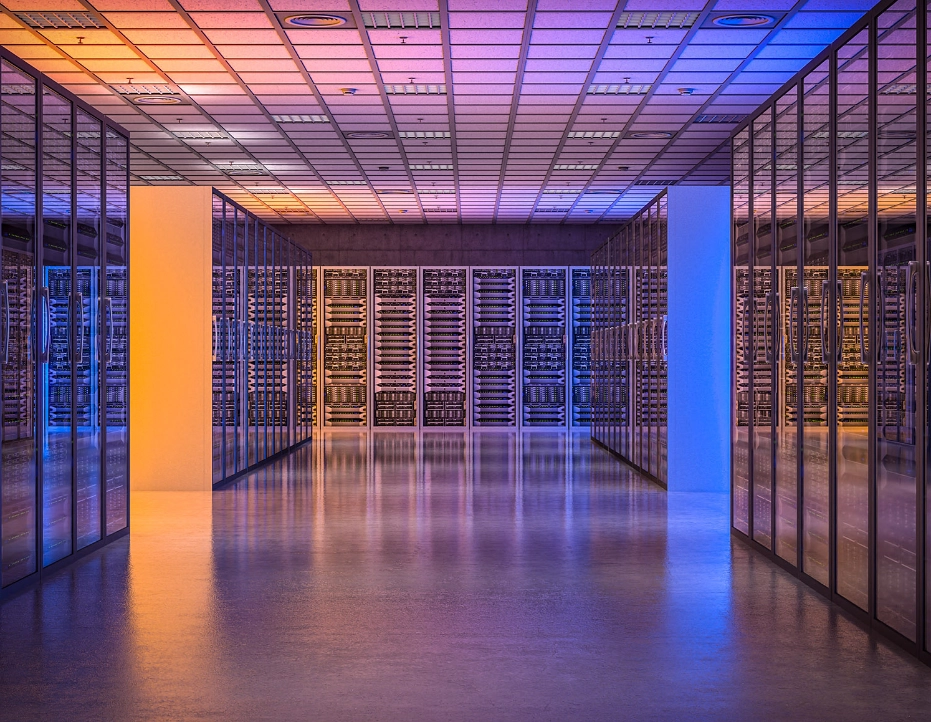

Another area brimming with M&A activity is the digital infrastructure realm, especially in the development of data centres, and to a lesser extent, tower assets. Activity continues in the UK and Europe, albeit at reduced levels for tower assets. Presently, data centres are the most sought-after asset class in the telecom and digital infrastructure sectors. Private capital investors, armed with record levels of capital, are increasingly investing in data centres, viewing them as stable, long-term assets amid economic uncertainty. These investors, along with major tech companies, are notably setting the pace for M&A opportunities in data centres and related energy infrastructure. There is a broadening appeal amongst investors for data centre opportunities powered by renewable energy or aligned with ESG agendas. However, this typically results in an increase in expected valuations or higher EBITDA multiples. Amid these swift developments, two critical trends emerge – power grid connectivity and planning challenges. The scale of these developments and their associated environmental impacts, particularly in green belt areas, can make data centres contentious among communities and local governments, posing further challenges to secure planning permissions.

Regulatory scrutiny continues to be a challenge for deal execution in the TMT sector, particularly for transactions of strategic importance to countries and those involving large technology companies. Recent years have seen active engagement from the global FDI regime, with authorities negotiating commitments or undertakings from parties. The UK shows signs of tightening regulatory measures, highlighted by the CMA's new test to investigate "killer acquisitions" (see our CRT killer acquisitions article here, but there seem to be some tailwinds of the potential easing of regulations by the UK government. On the other hand, the expected regulatory reforms under the Trump administration could lessen regulatory pressures, particularly on AI, and dial down on stringent antitrust laws, potentially boosting US M&A activity in this sector whilst simultaneously creating a ripple effect on a worldwide scale. Different strategies among regulators reflect a complex regulatory environment in the TMT sector, indicating that the influence on M&A trends will likely differ across specific sectors and regions. For more on managing the regulatory burden on transactions see our piece "Regulatory risk, some give some take".

In 2025, we anticipate growth and increased value in transactions in the TMT and digital infrastructure spaces. As companies strive to stay competitive in the face of digital transformation, we expect significant interest in AI and automation to persist across various industries and deal activity to continue to rise. Digital infrastructure, especially data centres, will likely continue to attract substantial investment. We also anticipate an uptick in highly structured deals given the increasing regulatory scrutiny, as businesses navigate the evolving landscape. Prized assets may see competitive processes but a valuation gap may remain a salient feature for other deals. Overall, general M&A themes across all sectors – bilateral deals running as auctions and deal carve-outs – will continue to be prevalent. We expect to see AI continue to stimulate M&A activity in the technology sector, but other sectors may not witness significant activity in the first half of the year.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2025

We’ll send you the latest insights and briefings tailored to your needs